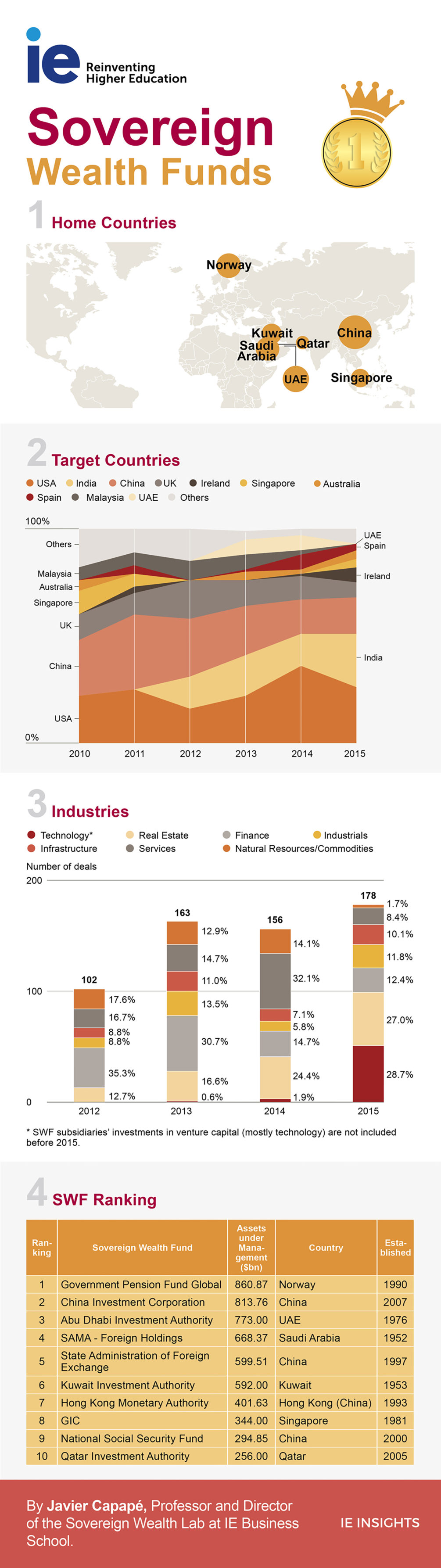

Sovereign wealth funds (SWFs) are government-owned funds that pursue a long-term investment strategy. A key characteristic of SWFs is that they are exempt from obligations to third parties. Therefore, unlike other public investments that must make regular payments—for example, pension funds—they have no periodic liquidity needs. Although SWFs are a relatively new form of financial instrument, the total wealth managed by these funds is equivalent to the combined GDP of Russia and Germany. The investment policies of SWFs are clearly influenced by their sheer volume and lack of short-term obligations to third parties. This infographic by Javier Capapé, Director of the Sovereign Wealth Lab at IE Business School, provides a global overview of these funds.

© IE Insights.