In today’s globalized market, it is not uncommon for large corporations—which are now larger than ever—to look abroad for sources of financing. The laws regulating certain securities transactions, including initial public offerings (IPOs), must evolve to keep up with changes in markets and technologies. The European Economic Area (EEA) has seen the beginnings of such an evolution in recent years, at least with regard to certain aspects.

The fundamental IPO document: the prospectus

Every IPO begins with a prospectus. This fundamental document describes the characteristics of the securities on offer and establishes the rules of the IPO itself, including deadlines and participation requirements. More importantly, it includes economic and financial information about the company seeking to raise capital. The prospectus must be approved by the appropriate regulatory authority—the National Securities Market Commission, in the case of Spain—and published ahead of the IPO.

A prospectus is required if the offering is public—that is, if it targets a minimum number of retail investors, who are entitled to certain protections. Information about the issuer of the securities is one such form of protection, as it allows investors to make an informed decision about whether to participate in the IPO. For similar reasons, a prospectus is also required if the securities are to be traded on a regulated market such as a stock exchange.

Under European regulations, jurisdiction is assigned to the country where the damage is incurred. Two main questions arise: What, precisely, is the damage? And where is it located?

The prospectus in a transnational IPO

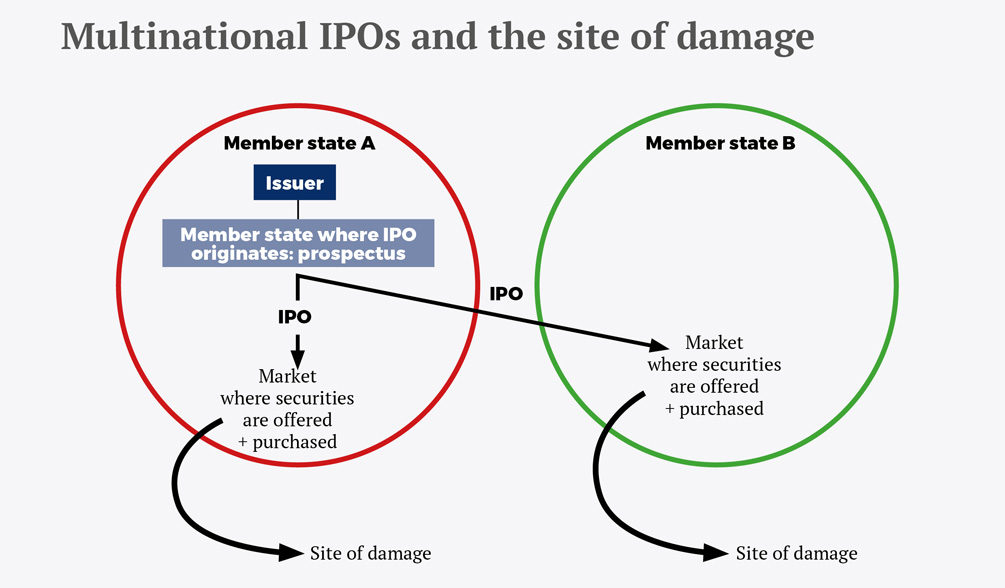

The situation is more complicated in cases where the IPO affects markets in multiple states.

In the EEA, disclosure requirements have been simplified: a system of mutual recognition has eliminated the need to prepare a different prospectus for each market involved in an IPO and to file each one individually with the appropriate national regulatory authority. This system was made possible by the fact that all EEA member states have practically identical regulations.

Civil liability arising from a misleading prospectus

What happens if a company includes misleading information about its financial situation in an IPO prospectus? Once the truth is revealed, the market value of the securities plummets, causing investors to lose money. Investors wronged in this manner are entitled to sue for damages. In a strictly domestic IPO—for which there is only one prospectus, approved by a single regulatory authority—the matter is straightforward: investors file lawsuits in that country, in accordance with local civil liability laws.

In transnational IPOs, however, the situation is different. When an IPO targets markets in multiple states, which country’s civil liability laws are applicable? How should the investors go about seeking compensation for damages? In this regard, the evolution of the law has lagged behind the harmonization of the regulatory framework.

Under European regulations, jurisdiction is assigned to the country where the damage is incurred. Two main questions arise: What, precisely, is the damage? And where is it located?

In today’s globalized environment, multinational IPOs within the EEA are commonplace. The unification of regulatory regimes has played a key role in allowing the mutual recognition of IPO authorizations through the so-called “prospectus passport” system.

The market as a legally protected good

The relevant damage can be interpreted as either the individual financial damage suffered by the investors or the supraindividual damage to the market caused by the publication of misleading information.

According to the latter interpretation, the direct damage—and indeed, the only relevant damage—is that done to the market’s pricing mechanism as a result of the publication of false information. In short, the damage is suffered by the market, and the market is located in the country where the misleading information was published. Consequently, the applicable laws, for civil liability purposes, are the national laws of the affected market.

Thus, in multinational IPOs—those which target multiple markets—multiple legal systems are applicable: one per affected market. This is a foreseeable outcome for both the issuer and the investors.

Regulatory proposal

The aforementioned solution, though reasonable, is not without controversy. Many authors have argued that the relevant damage is the financial damage suffered by individual investors. Moreover, the Court of Justice of the European Union, in its Kolassa ruling, reached conclusions that can be extrapolated to the question of jurisdiction. Kolassa refers, albeit confusingly, to individual damage. This line of reasoning leads to a frankly unsatisfactory conclusion: that the financial damage occurs in the investor’s place of residence, provided that the investor’s bank has an establishment in the same state. Thus, any country in the world could theoretically have jurisdiction, and the issuer of the securities cannot predict which one it will be.

In today’s globalized environment, multinational IPOs within the EEA are commonplace. The unification of regulatory regimes has played a key role in allowing the mutual recognition of IPO authorizations through the so-called “prospectus passport” system. Nevertheless, to put an end to the current situation of legal uncertainty, it is also necessary to clarify which country’s laws will apply in the event of a civil liability case involving damages arising from a misleading prospectus.

© IE Insights.