Since the global financial crisis of 2008, central banks stimulus has pumped liquidity into markets and this excess liquidity, easy borrowing, and excess leverage, combined with significant growth in passive investing and declining numbers of public companies, has led to a great imbalance in supply and demand. This in turn has sent risk asset prices spiraling ever upwards – but the era of central bank liquidity is now drawing to a close.

As central banks start to taper the enormous amounts of liquidity injected into the markets, the supply of liquidity will become more variable and public markets will in turn be more susceptible to substantial shocks from both macro and micro factors. This means investors will no longer be able to count on intervention to support rising asset prices.

Today, we could say that investors have to overcome significant obstacles to achieve their goals. Indeed, they have faced daunting challenges over the last 30 years to generate sufficient returns and in the coming years, investment outcomes face increasing uncertainty. It seems we are on the verge of a new development, with a shift towards fewer public companies and more private companies.

Over the last 20 years, both public and private markets have evolved and may now be on the brink of a step change, or at least about to give way to something rather less forgiving. The first evolving change has been the decline in the number of public companies in the United States, which has fallen by 50% in the last 20 years. Recent S&P data suggests there are only 2,600 public companies with revenues exceeding USD 100 million vs. nearly 17,000 private companies of this size.

The headline trend is that shrinkage continues in public markets. The number of companies listed in both the U.S. and Europe declined by 2.2% per annum between 2010 and 2020, falling to 11,391 in 2020 and now at 30% below the past decade’s peak of 16,500 in 2011. Meanwhile, the number of private equity-backed companies has increased by 5.7% per annum over the same period.

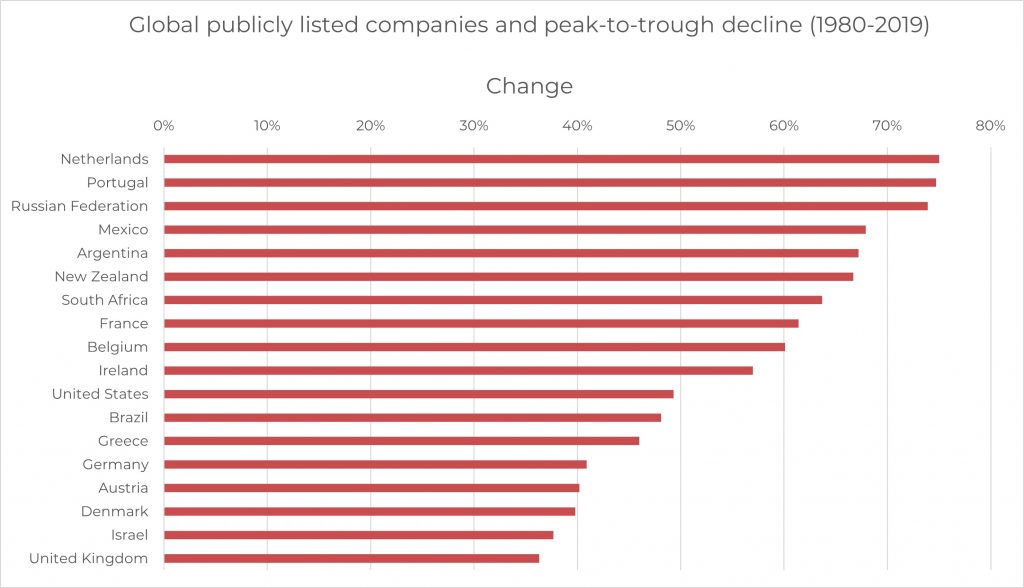

This trend is part of a longer-term evolution. The number of publicly listed companies grew fairly steadily through most of the 1980s and 1990s, before starting to level-off in 2000 and then declining in 2014. While the declines are particularly pronounced in the U.S., which has a more mature private equity market, they are occurring globally, with 18 countries (including many with large economies) experiencing peak-to-trough declines of between 30-75% in the number of listed companies.

World Bank data shows these changes by countries. Global publicly listed companies and peak-to-trough decline (1980-2019):

The underlying factors behind this trend are still playing out. But, the widest range of choice for investors now lies in private, rather than public, markets. Today, public markets may not offer the breadth of options they did 25 years ago. In fact, as investors seek to navigate an unprecedented market regime, it looks like private market investments are well suited to the task. It is therefore time for investors to adapt and address the opportunities in private markets – and to do so with innovative structures, detailed and precise analysis, and a flexible approach.

Most investors are structurally underweight to private markets investments and are not accessing the significant premium that somehow is critical to meeting return objectives. Not only is there a large number of companies open to investors, but private markets also offer a huge spectrum of highly differentiated businesses and assets across a range of markets and sectors. This means investors can find the opportunities best suited to their own unique needs and objectives. But, what will drive outperformance in private markets? Well, it seems that investors must be more active in the management as well as their private markets portfolios.

There is both an evolution and revolution in the markets. Private equity as an asset class has demonstrated its resilience and continues to outperform public markets over long periods. Moreover, private equity tends to outperform public markets by wider margins during periods of volatility and broader equity market contraction. Private equity investments have generated attractive returns over the past three decades and have been a source of alpha for broad investors’ portfolios. Private equity returns have recovered post-global financial crisis and continued to deliver positive and solid returns despite market volatility. During the pandemic period, private equity produced the strongest performance since the global financial crisis.

On the other hand, adding private equity to an investor portfolio can improve portfolio diversification. Through private equity, investors enter a much larger universe of unquoted assets compared to listed equities. Furthermore, listed stocks have been shrinking in recent years, particularly in the US while private companies stay longer private, supported by private equity capital and value creation under private equity ownership. Thus, investors have access to new and growing industries and companies long before they become public. As a result, private equity returns exhibit a lower correlation to public equity markets.

Transactions continue to grow in size, and they are becoming increasingly global – and it appears that there is room for continued private markets growth versus public markets. As the private markets have developed, they have increasingly become an important source of capital when compared to public markets.

Companies now have the choice as to whether to go public or private for their financing needs, and often companies will move back and forth between the markets at different stages during their life. The private markets benefit from a greater pool of potential investments, but participants need to be able to address both public and private or they risk losing an investment relationship with a strong corporate.

The evolving private equity industry shows no signs of a slowdown. The size of the private equity market has tripled in the last decade, from around $2 trillion in 2010 to over $6 trillion in 2021. The number of active private equity investors has tripled as well, as access is democratized.

Private equity still makes up only a small fraction of total global equity markets, but that does not mean it should be overlooked. The year 2022 has begun with the private markets in good health, with private businesses rebounding from the challenges of 2020 and readying for the challenges of the future. Deployment is at an all-time high and new businesses and opportunities, such as secondary investing, in which investors purchase from other investors rather than from the companies themselves, are growing.

A big advantage of public markets is the liquidity possibilities. However, in the private markets, secondary activity is at center stage. Within private markets verticals, we can see fast-growing spaces such as secondaries facilitating exposure to assets that are remaining private for longer. Investors are also looking beyond the edges that have traditionally defined their space, for example to see if there is value in participating earlier in a corporate life cycle (such as growth) or investing in assets which bring together different sectors such as energy and fiber delivery to homes. Investors increasingly need to be multi-dimensional in order to identify and underwrite these opportunities.

In fact, secondaries have proven to be a practical tool for efficient portfolio management, as well as for gross profits or limited partnerships seeking liquidity. But this is another topic for another time.

© IE Insights.